CHAPTER 4 a EMPLOYMENT INCOME - DERIVATION - ATXB213 MALAYSIAN TAXATION 1 1. If the premise is a special purpose commercial building like a factory warehouse.

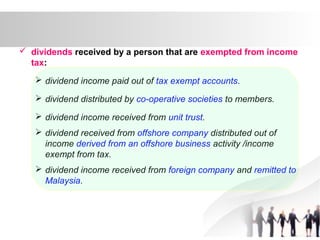

Taxation Principles Dividend Interest Rental Royalty And Other So

Short title extent and commencement 2.

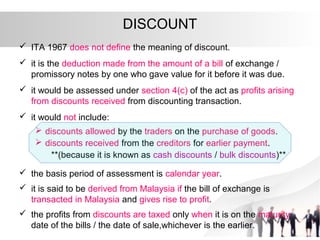

. Income under Section 4f ITA 1967. B Page 1 of 26 1. 1341 Sales Tax 13411 Effective date and scope of taxation Sales tax is a single-stage tax imposed on taxable goods manufactured locally by a registered manufacturer and on taxable goods imported by any person.

Derivation of business income in certain cases 13. And references in this section to income in relation to any settlement or arising under the settlement. Notwithstanding section 4 and subject to this Act the income of a person not resident in Malaysia for the basis year for a year of assessment in respect.

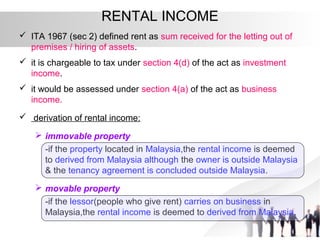

LAWS OF MALAYSIA Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. When rental income is assessed under section 4 d it has to be grouped into three sources namely residential properties commercial properties and vacant land. - Announcement Regarding The Application Of Subsection 77A 4 And Section 140B Of The Income Tax Act ITA 1967 - Schedule of Average Lending Rate Bank Negara Malaysia ALR - Section 140B.

DEFINITION OF EMPLOYMENT Employment is defined in Sec 2 ITA 1967 employment in which the relationship of master. Restriction On Deductibility Of Interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction On Deductibility Of Interest Rules 2019 PU. And there are parts which have been customised to ensure adherence to the Act and Inland Revenue Board of Malaysias IRBM procedures as well as domestic.

Derivation of rental income. SCOPE OF APPLICATION 6. The new guidelines are broadly similar to the earlier guidelines and explain the penalties that will be imposed under Section 1123 of the Income Tax Act 1967 ITA Section 513 of the Petroleum Income Tax Act 1967 PITA and Section 293 of the Real Property Gains Tax Act 1976 RPGTA where a taxpayer fails to furnish a tax return within.

LEARNING OBJECTIVE ATXB213 MALAYSIAN TAXATION 1 2. 134 Indirect taxes Sales Tax and Service Tax SST came into effect in Malaysia on 1 September 2018. LAWS OF MALAYSIA Act 543 PETROLEUM INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS P ART I PRELIMINARY Section 1.

10 March 2011 Issue. This R uling explains. SECTION 140C INCOME TAX ACT 1967 DATE OF PUBLICATION 05072019.

The date of commencement of renting is on the first. Section 4 2 of Income Tax Act. Any appointment or office whether public or not.

Short title and commencement 2. It would be assessed under section 4 a of the act as business income. Malaysia will find their tax position to be uncertain.

The Income Tax Act 1967 which is referred to as the principal Act in this Chapter is amended in subsection 51a by inserting after the words 109d the words 109da in respect of a non-resident unit holder other than an individual. Charge of income tax 3 A. Finance 9 Amendment of section 5 4.

So do these new changes in Section 12 provide more clarity or introduce more confusion as to the source of income for Malaysian tax purposes. A Public Ruling as provided for under section 138A of the Income Tax Act 1967 is issued for the purpose of providing guidance for the public and officers of the Inland. A company can have its rental income assessed as Section 4 a business income if it is letting at least 4 units of commercial buildings 4 floors of shop houses 4 units of residential properties or any combinations of 4 units of the type of premises mentioned.

Immovable property -if the property located in Malaysia. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5363CSpecial treatment on rent from the letting of real property of a Real Estate Investment Trust or Property Trust Fund.

DomesticIssues Chong Mun Yew Malaysia has recently introduced an amendment to Section 12 of the Income Tax Act 1967 ITA. 1 This Act may be cited as the Income Tax Act 1967. Clue of what section 4 Income Tax Act 1967 trying to classify.

Payments that are made to NR payee in respect of the above income are subject. Interpretation P ART II IMPOSITION OF THE TAX 3. Manner in which chargeable income is to be ascertained P ART III ASCERTAINMENT OF CHARGEABLE.

TABLE OF CONTENTS PAGE 1. 42011 Date of Issue. Throughout Malaysia--28 September 1967 PART I PRELIMINARY Short title and commencement 1.

INLAND REVENUE BOARD MALAYSIA INCOME FROM LETTING OF REAL PROPERTY Public Ruling No. It is chargeable to tax under section 4 d of the act as investment income. Charge of petroleum income tax 4.

Any particular dealing or transactions must come within the walls of scope. INTRODUCTION OBJECTIVE 1 1 3. In Malaysia income tax is generally governed by Income Tax Act 1967 Act 531967.

INCOME TAX ACT 1967 Incorporating all amendments up to 1 January 2006 053e FM Page 1 Thursday April 6 2006 1207 PM. Every person who in whatever capacity is in receipt or has control of any money or property being income of the kind mentioned in section 4 of or belonging. RENTAL INCOME ITA 1967 sec 2 defined rent as sum received for the letting out of premises hiring of assets.

It will also give the readers an overview of what is income in revenue law. And often allow notional reductions of income. In respect of income chargeable under sub-section 1 income-tax shall be deducted at the source or paid in advance where it is so deductible or payable under any provision of this Act.

And there are parts which have been customised to ensure adherence to the Act and Inland Revenue Board of Malaysias IRBM procedures as well as domestic circumstances. CHARTERED TAX INSTITUTE OF MALAYSIA 225750-T e-CTIM TECH-DT 222014 26 March 2014 Page 2 of 2 Please read the following announcements at the IRB website. Income falling under Section 4f of the Income Tax Act 1967 ITA 1967 includes any other income that is not obtained from business employment dividends interests discounts rents royalties premiums pensions or annuities.

Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5382ADuty to keep documents for ascertaining chargeable income and tax payable. 4 Laws of Malaysia ACT 53 Section 11. Unannotated Statutes of Malaysia - Principal ActsINCOME TAX ACT 1967 Act 53INCOME TAX ACT 1967 ACT 5363CSpecial treatment on rent from the letting of real property of a Real Estate Investment Trust or Property Trust Fund.

Rental income is generally assessed under Section 4 d Rental Income of the Income Tax Act and is seen as income from investment. Income falling under paragraph 4 f chargeable to tax 41 The introduction of a new section 109F of the ITA with effect from 01012009 provides a mechanism to collect withholding tax from a non-resident person who receives income which is derived from Malaysia in respect of gains or profits that fall under paragraph 4 f of the ITA. Non-chargeability to tax in respect of offshore business activity 3 C.

An Act for the imposition of income tax. And references in this section to income in relation to any settlement or arising under the settlement.

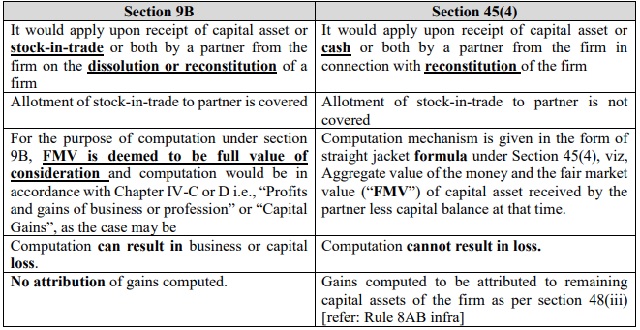

Redesigned Taxation On Reconstitution Dissolution Of The Firm A New Jeopardy Capital Gains Tax India

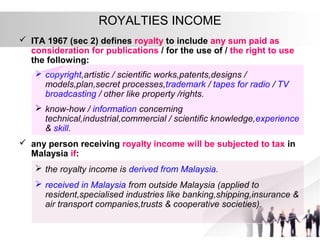

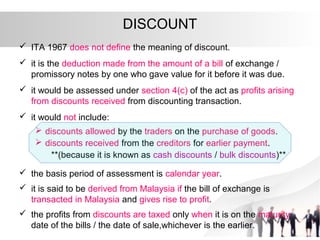

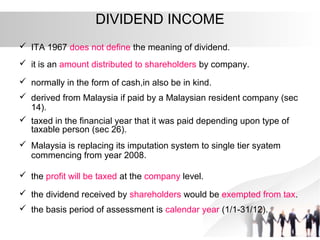

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

What Is Local Income Tax Types States With Local Income Tax More

Taxation Principles Dividend Interest Rental Royalty And Other So

Taxation Principles Dividend Interest Rental Royalty And Other So

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Overview Of Malaysian Taxation By Associate Professor Dr Gholamreza Zandi Ppt Download

As An Employer What Are Their Obligations In Terms Of Income Tax

Several Types Of Assessment Under The Income Tax Act Enterslice

Problem Based Learning Project Tax Computation On Malaysian Food Service Mfs Sdn Bhd Group B Namematrik No Izwani Bt Abdul Majid Hazwani Bt Ghazali Ppt Download

Section 194r Of The Income Tax Act Brief Analysis Enterslice

Standard Deduction Tax Exemption And Deduction Taxact Blog

What Is Speculative Transactions Under Income Tax Act Enterslice

The Savemoney My Property Transaction Costs Estimator Work From Home Business Transaction Cost Tv Moms

Taxation Principles Dividend Interest Rental Royalty And Other So